Flipkart to offer lending services, to help sellers with working capital

It’s common knowledge that one of the biggest advantages of online retail is the significantly lesser working capital required to start operations, as compared to offline retail. However, as one starts selling online, expansion is necessary to keep abreast with the changing trends and give more choices to online customers.

Flipkart to offer lending services

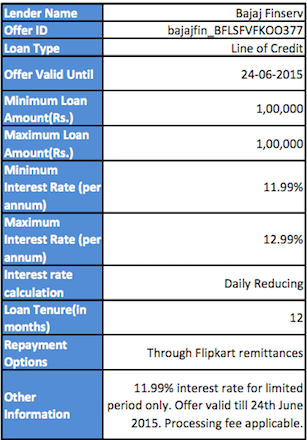

In an email to sellers, online marketplace Flipkart has informed them of lending services to help in improving and expanding their online selling operations. Sellers can use the service, which is in tie-up with Flipkart’s third-party service providers, to procure working capital funds. These funds can further be utilized to fine tune and improve the following:

- Inventory

- Infrastructure

- Listings

- Offerings to customers

Help to Indian online sellers?

No doubt, a shortage in cash-flow affects workflow, thus affecting the performance of the seller, and in turn Flipkart’s. So in an attempt to free sellers of the worries of gaps in cash-flow, Flipkart has extended this service to sellers on its platform.

Access this link for more information and offers.

With easing of cash-flow worries, sellers can focus more on business and expansion. Don’t you think?

Disclaimer from Flipkart

Flipkart under this lending program is merely providing a technology platform and is not acting as a financial intermediary or soliciting any financial business. Flipkart shall not be responsible for repayment of loan or any other liability that may arise as a result of any breach by seller or lender, as the case may be.

About Author

After dwindling with her family business, into travel and hospitality, for more than 3 years, Pooja Vishant found her true love in writing. Happy-go-lucky and cheerful, she loves pink; so pink is the way to go if you want to get into her good books. The Associate Editor keeps track of even a leaf that has moved in the ecommerce world!

Leave a Comment